missouri gas tax refund

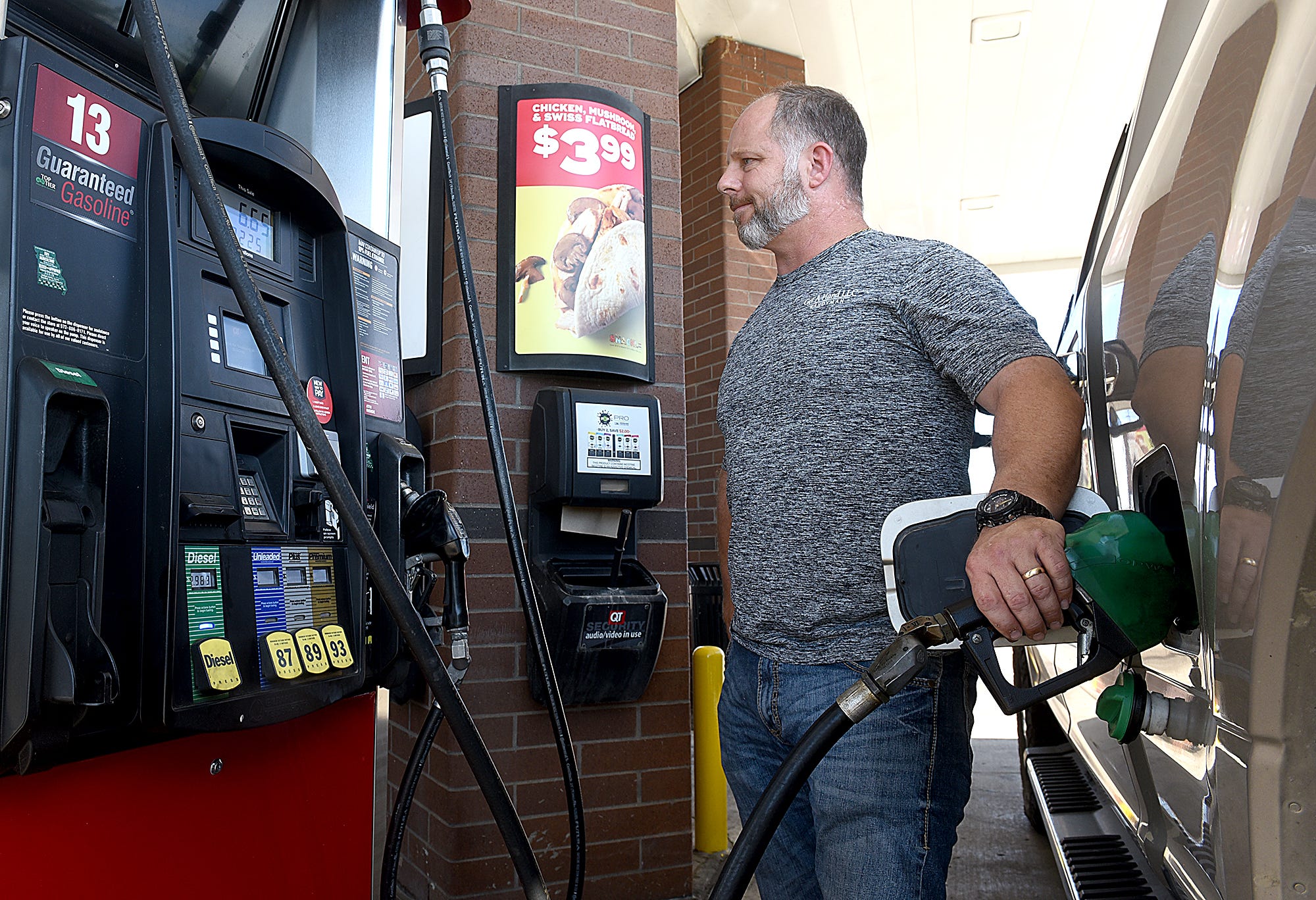

The legislation includes a rebate process where drivers could get a refund if they save their gas receipts and submit them to the state. App launched to help Missouri drivers get refunds at gas pump.

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

1 day agoIn July 2021 Gov.

. The bill increases the states fuel tax by 25 cents every year refundable to most Missouri drivers. With the average price of a gallon of gas in Kansas and Missouri still at 381 everyone is looking for ways to. 2 Make sure to save your gas receipts to get reimbursed starting July 1 2022.

Seller number of gallons purchased and price per gallon Missouri fuel tax and sales tax if applicable as separate items. It was the first time in 25 years the states gas tax increased. Form 4923 must be accompanied with a statement of Missouri fuel tax paid for non-highway use detailing the motor fuel purchased.

The tax which was signed into law by Gov. In 2026 the refundable gas tax will raise gas. MISSOURI residents can request a reimbursement on a gas tax this year - but only if they keep track of their receipts.

JEFFERSON CITY Mo. Motor Fuel Tax Taxes on gasoline diesel oil aviation fuel gasohol ethanol and any other fuels used in motor vehicles or aircraft. There is a way for Missourians to get.

Missouris gas tax is 195 cents after the 25 cent increase in October 2021. The state increased their gas tax in October of last year adding 25 cents per gallon. The tax refund only applied to the new 25 cents per gallon tax increase and not Missouris existing 17 cents per gallon gasoline tax.

Missourians can request a. Vehicle for highway use. Form 4924 can be submitted at the same time as Form 4923.

The State of Missouri currently has one of the lowest gas tax rates in the country at 17 cents per gallon. 1 2021 through June 30 2022. You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if.

Mike Parson signed a gas tax increase into law that raises tax from 17 cents per gallon to 295 cents per gallon in increments. This bill allows purchasers of motor fuel for highway use to request a refund of the Missouri motor fuel tax increase paid annually. The 25 cents per gallon increase will gradually raise over the next five years.

Mike Parson in July raises the price Missouri drivers pay on gasoline by an additional 25 cents per gallon every year until 2025 for. Instructions for completing form. Fuel bought on or after Oct.

Under Ruths plan the gas tax would rise by two cents per gallon on Jan. Missouri Form 4923 Motor Fuel Refund Claim 2014-2022. Tax Refund Application must be on file with the Department in order to process this claim and may be submitted at the same time as Form 4923.

The news of this refundable gas tax has been widely reported. Any Missouri drivers who maybe dont agree with the increase or would like to receive a refund can hold onto their gas receipts Fuel-ups in. 1 day agoMissouri drivers can get a refund from the state on the increased gas tax.

Once fully implemented the gas tax hike could generate more than 500 million annually for state county and city. Missouris motor fuel tax rate will increase by 25 cents per gallon annually on July 1 until it reaches 295 cents in July 2025. According to Missouri DOR.

In October Missouri increased its statewide fuel tax from 17 cents per gallon to 195 cents per gallon. Use a missouri fuel refund 2014 template to make your document workflow more streamlined. The state announced possible refunds of the 25 cents tax increase per gallon paid on gas.

Missouri Department of Revenue creating refund claim form for gas tax by Ryan Pivoney September 28 2021 at 405 am. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Refund claims must be submitted on or after July 1st but no later than September 30th following the fiscal year in which the tax was paid.

The tax will continue to increase 25 cents a year until it hits 295 cents in 2025. Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. 1 2022 and will then increase by an additional two.

Becky Ruth chair of the House Transportation Committee. Form Print Form Missouri Department of Revenue Motor Fuel Refund Claim Form Office Use Only Keyed Date Document No r FEIN r Social Security Number r Driver License Number Name City. Form 4924 Motor Fuel Tax Refund Application must be on file with the Department in order to process this claim.

The State of Missouri currently has one of the lowest gas tax rates in the country at 17 cents per gallon. The gas tax will go up 25 cents every year for the next few years until the gas tax reaches about 30 cents per gallon in Missouri. Vehicle weighs less than 26000 pounds.

The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. For someone who drove 15000 in a year in a vehicle averaging 30 miles per gallon the refund on the 25-cent tax would be 1250. What Does the Missouri Gas Tax Rebate Mean for You.

Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes. 1 until the tax hits 295 cents per gallon in July 2025. Around that time the Missouri DOR announced Missourians might be eligible for refunds of the 25 cents tax increase per gallon paid on gas purchases after Oct.

Instructions for completing form. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon. There is a way for Missourians to get.

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

5 Smart Ways To Use Your Tax Return Millennial In Debt Money Management Advice Money Saving Strategies Saving Money Quotes

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

Missourians Can Apply For A Gas Tax Refund Later This Year

Nomogastax App Gives Missourians The Option To Get Their

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

Missourians Can Apply For A Gas Tax Refund Later This Year

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

The Average Tax Refund Is 300 Higher This Year Money

Free Need We Say More Have You Taken Your Bike On The Road Yet This Summer We Know The Weather S Been Great So It S Your Mo Bike Bike Illustration Bicycle

Use Our Fuel Calculator To Estimate Your Fuel Excise Tax Refund

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Black Monday For Small Cap Value Theo Trade Small Caps Black Monday Nasdaq 100

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Average Gas Prices In The U S Through History Gas Prices History Infographic Infographic

/cloudfront-us-east-1.images.arcpublishing.com/gray/TWLAHS3UMZCJ7BZ553JPXH4WAA.png)